On January 4, 2018 the Company announced the results of an updated positive feasibility study ("the Project") to process the heap leach material and additional open-pit mineral reserves at its Mineral Ridge property ("the Property"). This updated feasibility study includes the economic results of processing the reserves, in addition to the previously issued feasibility study (refer to press releases of October 10, 2017 and November 6, 2017) which considered only the processing of the heap leach pad reserves.

Economic Parameters

The economic viability of the Project has been evaluated using constant dollar after-tax discounted cash flow methodology. This valuation method requires projecting material balances estimated from operations and calculating resulting economics. Economic value is calculated from sales of metal, plus net equipment salvage value and bond collateral less cash outflows such as operating costs, management fees, capital costs, working capital changes, any applicable taxes and reclamation costs. Of the $67.5 million in total capital required for the Project, $28.9 million is financed through a capital lease. Resulting annual cash flows are used to calculate the net present value and internal rate of return of the Project.

The economic evaluation is based on the estimated Mineral Reserves on the heap leach pad as of June 29, 2017, plus the Mineral Reserves estimated in other areas that can be mined using open pit methods. Since the Project entails use of infrastructure active up to, and including, the time of capital investment, continuity of administrative and certain operational activities is expected, which allows certain costs to be determined based on actual history. Otherwise, operating and capital costs for proposed new activities have been derived by third-party engineers.

During the Project life (one year of initial capital investment and seven-and-one-half years of operation), the site will undergo further evaluation to extend its operating life, and as such, no end-of-project reclamation is included in this Project analysis.

The open-pit mining equipment is assumed to be acquired through a capital lease. The lease is modeled at a four-year term at 6% interest. Interest payments are reported as cash operating costs, principal payments reduce cash as a financing activity and costs are booked as assets on the balance sheet.

Economic Results

Based on the economic parameters summarized above, the Project returns a NPV5% (after-tax) of $35.1 million and an IRR of 30.0%, and achieves payback in 2.9 years (Table 6).

Table 6: Economic Results

| Area | Unit | Total/Average |

|---|---|---|

| Construction Period | years | 1 |

| Operating Period | years | 7.5 |

| Heap leach Pad Material Milled | kt | 6,855 |

| Average Leach Pad Gold Grade | opt | 0.017 |

| ROM Material Milled | kt | 3,712 |

| ROM Material Gold Grade | opt | 0.042 |

| Recovery After Process and Refining | % | 91.6 |

| Life of Project Gold Sold | koz | 250.5 |

| Average Annual Gold Sold | koz/a | 33.4 |

| Gold Price | $/oz | 1,250 |

| Realized Gold Price | $/oz | 1,249.50 |

| Average Silver Grade | opt | 0.017 |

| Average Annual Silver Sold | koz/a | 3.7 |

| Realized Silver Price (Average) | $/oz | 19.81 |

| Total Cash Cost | $/oz | 805 |

| Initial capital expenditures | $ million | 34.9 |

| Remnant Ore Capital Expenditures (Ops Year 6) | $ million | 32.6 |

| Total After-tax Net Cash Flow | $ million | 53.5 |

| Net Salvage Value | $ million | 13.1 |

| NPV of Net Cash Flow Discounted at 5% | $ million | 35.1 |

| IRR | % | 30.0 |

| Payback from End of Construction | years | 2.9 |

Management anticipates that the Project returns could potentially be further enhanced through the judicious sourcing and refurbishment of certain used equipment, available for purchase in the south-western United States. However, no economic studies have been undertaken with respect to sourcing and refurbishing used equipment, including the Feasibility Study which is based on new equipment only.

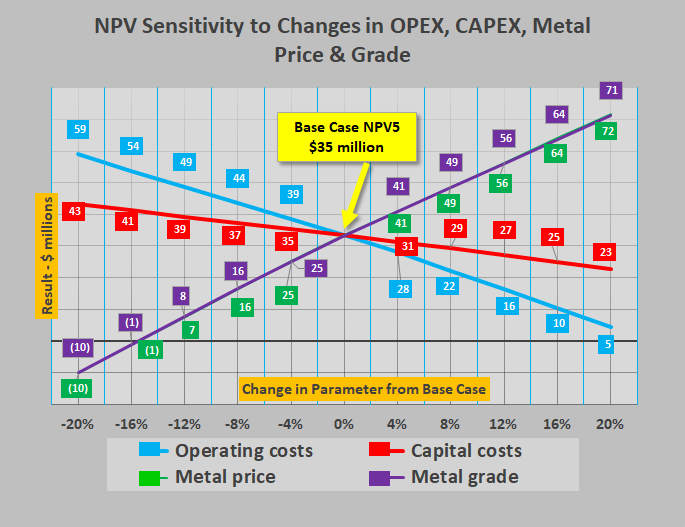

Sensitivity Analysis

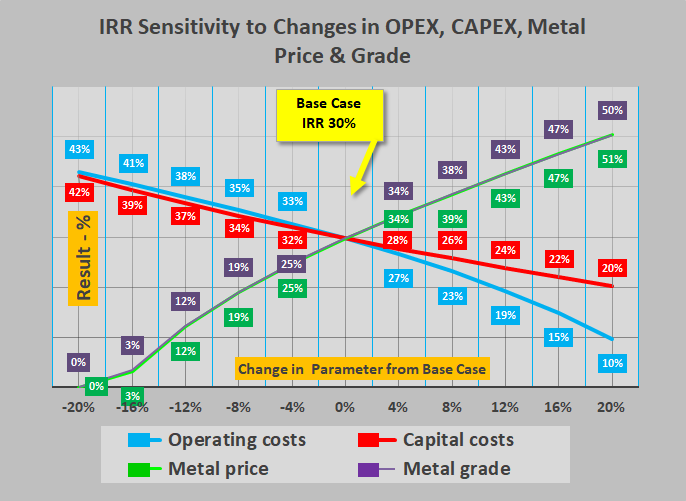

Project sensitivity to variations in operating costs, capital costs, gold grade and metals price was evaluated with respect to the NPV. The NPV5% (after-tax) of the Project is more sensitive to changes in metal price and metal grade, as compared to changes in CAPEX and OPEX. For example, at a gold price of $1,100/oz, a 12% decrease, the NPV5% (after-tax) decreases to $10 million and the IRR declines to 13%. At a gold price of $1,400/oz, a 12% increase, the NPV5% (after-tax) increases to $58 million and the IRR increases to 43%.

The NPV sensitivity to CAPEX, OPEX, gold price and head grade is shown graphically in Figure 1 below

Note: Figure prepared by MTS, 2017

Similarly, the sensitivity of the IRR to CAPEX, OPEX, gold price and head grade is shown graphically in Figure 2 below.

Note: Figure prepared by MTS, 2017

Conclusions

Based on the updated Feasibility Study, the Project, as defined in the technical report, is technically and economically viable. It is therefore recommended that Scorpio Gold construct the new processing facilities as described, to process the heap leach material as well as the reported open-pit reserves at the Property.

Units of Measure

Unless otherwise defined herein, the following defined terms have the following meanings:

| Unit< | Symbol |

|---|---|

| foot | m |

| gram | g |

| ounce | oz |

| pound | lb |

| ton (short = 2,000 lb) | t |

| ounces per ton | opt |

| kilo (x 1,000) | k |

| million (x 1,000,000) | N |

| hour | h |

| minute | min |

| year | y |

| day | d |

| annum | a |

| tons per hour | tph |

| tons per day | tpd |

| tons per annum | tpa |

| US gallon | gal |

| cubic feet | ft3 |

| US gallons per minute | gpm |

| US dollars | $ |

Qualified Persons

The following are Qualified Persons ("QP"s) as defined by NI 43-101 and participated in the preparation of the feasibility study:

| Qualified Person | Company | QP Responsibility/Role |

|---|---|---|

| Mr. Todd Wakefield, RM-SME | Mine Technical Services | Geology |

| Ms. Stella Searston, RM-SME | Mine Technical Services | Geology |

| Mr. Ian Crundwell, P. Geo. | Mine Technical Services | Mineral Resources |

| Mr. Jeff Choquette, P.E. | Hard Rock Consulting, LLC | Mineral Reserves and Mining Methods |

| Mr. Paul Kaplan, P.E. | NewFields | Environment Studies and Permitting |

| Mr. Gordon John Cooper, P. Eng. | Novus Engineering Inc. | Mineral Processing |

| Mr. Amritpal Singh Gosal, P. Eng. | Novus Engineering Inc. | Infrastructure and Plant Design |

| Mr. Bruce Genereaux, RM-SME | Mine Technical Services | Economic Analysis |

An NI 43-101 compliant technical report in support of the resource and reserve estimates and associated updated feasibility study was filed on SEDAR on January 9, 2018.